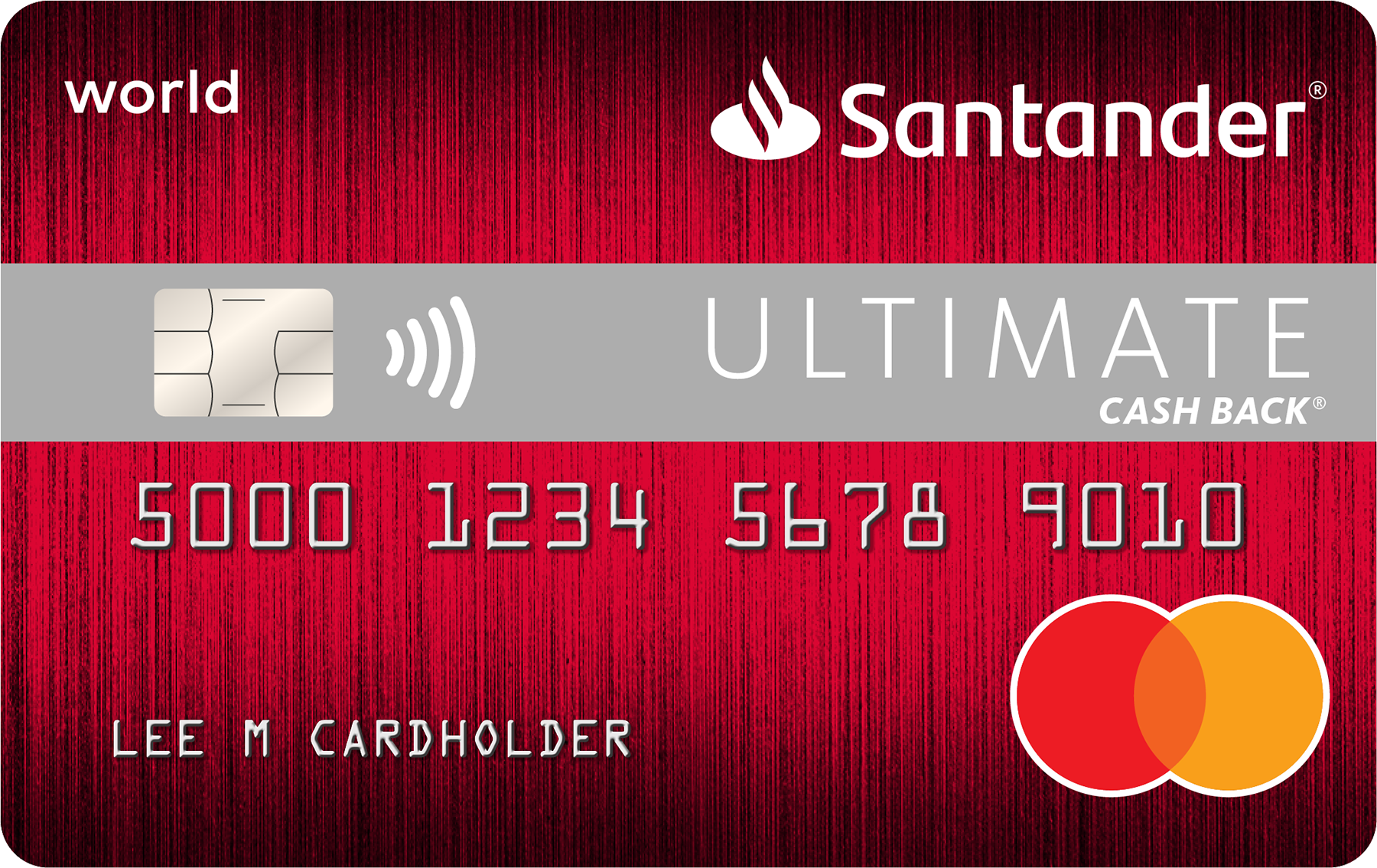

Introduction to Santander Credit Card

Are you looking for a credit card that can seamlessly adapt to your lifestyle while offering unparalleled flexibility? The Santander Credit Card might just be the perfect match for you. Designed with your financial needs in mind, it offers an array of features that empower you to make smarter spending decisions. Whether you’re planning a weekend getaway or simply managing everyday expenses, this credit card is equipped to support your goals. Let’s dive into how the Santander Credit Card can enhance your financial journey and provide benefits tailored just for you!

Benefits of Using Santander Credit Card

The Santander Credit Card offers a range of benefits that can enhance your financial flexibility. One standout feature is the competitive interest rates, which make borrowing costs manageable.

Rewards programs are another major advantage. You earn points for every purchase, allowing you to redeem them for travel, shopping discounts, or cashback options.

Additionally, cardholders enjoy exclusive access to promotions and deals from various partners. This means more savings on everyday expenses and special purchases alike.

Safety features also play a crucial role in its appeal. With fraud protection services and zero liability policies, peace of mind comes standard with your card.

Managing finances is simplified through user-friendly online tools and mobile apps. Tracking spending has never been easier!

How to Apply for a Santander Credit Card

Applying for a Santander Credit Card is straightforward and convenient. Start by visiting the official Santander website or your local branch to explore the different card options available.

Once you’ve chosen a card that suits your needs, gather the necessary documentation. This typically includes proof of income, identification, and details about your financial history.

Next, complete the online application form or ask for assistance at a branch. Be prepared to provide personal information such as your Social Security number and address.

After submitting your application, wait for approval notification. Depending on various factors like creditworthiness, this can be quick or may take several days.

If approved, you’ll receive your new credit card in the mail shortly after! Enjoy exploring all it has to offer while managing it responsibly from day one.

Different Types of Santander Credit Cards

Santander offers a variety of credit cards designed to meet different needs and lifestyles. Each card comes with unique features that cater to various spending habits.

The Santander Zero Credit Card is ideal for those who want to save on interest fees. It typically has no annual fee, making it budget-friendly for occasional users.

For travel enthusiasts, the Santander Travel Rewards Card provides points on every purchase that can be redeemed for flights or hotel stays. This card is perfect for frequent travelers looking to maximize their rewards.

If you prefer cashback benefits, the Santander Cash Back Card delivers just that—earn cash back on everyday purchases like groceries and dining out.

There’s the Santander Student Credit Card tailored specifically for students. It helps build credit history while offering manageable limits and useful educational resources about responsible borrowing.

Features and Services Offered by Santander Credit Card

The Santander Credit Card comes packed with features designed to enhance your financial experience. One standout is the customizable spending alerts. These notifications keep you informed and help manage your budget effectively.

Another key service is the easy-to-use mobile app. With it, accessing your account information or tracking expenses becomes a breeze. You can monitor transactions in real-time, ensuring you stay on top of your finances.

Additionally, cardholders benefit from zero liability protection. This means you’re not held responsible for unauthorized purchases made with your card.

Santander also offers various rewards programs that allow you to earn points for every dollar spent. Whether traveling or shopping locally, these rewards add value to everyday purchases.

Moreover, access to exclusive discounts and promotions through partner retailers makes shopping even more rewarding.

Tips for Maximizing Your Rewards and Benefits with Santander Credit Card

To get the most out of your Santander Credit Card, start by understanding its rewards structure. Familiarize yourself with which categories earn you the highest points or cashback. This knowledge helps you strategize your spending.

Next, consider pairing your card with a loyalty program. Many retailers offer additional rewards for cardholders who shop frequently at their stores. Linking both can multiply your benefits significantly.

Always pay attention to promotional offers and seasonal bonuses that may come up throughout the year. These limited-time deals can enhance your earning potential dramatically.

Don’t forget about automatic payments! Setting them up ensures that you never miss due dates while also maximizing any cash-back incentives tied to on-time payments.

Regularly review your account statements and reward balance. This practice allows you to stay informed about what you’ve earned and how best to redeem those rewards efficiently.

How to Manage Your Santander Credit Card Account

Managing your Santander Credit Card account is straightforward and user-friendly. Start by registering for online banking. This gives you access to transaction history, payment options, and other essential features.

Set up alerts for due dates and spending limits to stay informed about your finances. These notifications can help prevent missed payments or overspending.

Consider using the mobile app for on-the-go management. It allows you to check balances, review transactions, and make payments with ease.

Establish a budget based on your credit limit and monthly expenses. This strategy helps in maintaining control over your spending habits while maximizing rewards.

Regularly review your statements for any discrepancies or unauthorized charges. Reporting issues promptly ensures better protection of your financial security.

Pay more than the minimum amount when possible. Doing so reduces interest costs and helps maintain a healthy credit score.

Frequently Asked Questions

The Santander Credit Card is a versatile financial tool designed to enhance your shopping experience while providing valuable features. Here are some common questions people often have about this credit card.

What makes the Santander Credit Card unique?

The Santander Credit Card stands out due to its wide range of rewards and flexible financing options tailored for various lifestyles. It offers multiple types of cards, each catering to different needs, from cash back to travel rewards.

How do I know which Santander Credit Card is right for me?

Choosing the right card depends on your spending habits and lifestyle. If you frequently travel, a rewards card focused on travel benefits may suit you best. If everyday purchases are more your style, consider one that maximizes cash back or points in categories where you spend the most.

Are there any fees associated with the Santander Credit Card?

While many Santander credit cards come with no annual fee, it’s essential to read through the terms and conditions carefully. Some transactions might incur foreign transaction fees or late payment penalties, so being aware can help avoid surprises.

Can I manage my account online?

Yes! The Santander app allows users to manage their accounts easily from anywhere. You can check balances, pay bills, view transactions and even track rewards—all at your fingertips.

Is customer service available if I need help?

Absolutely! Santander provides robust customer support through various channels including phone assistance and online chat services. Whether you have questions regarding payments or need help resolving issues, assistance is just a call away.

By exploring these FAQs and understanding how the Santander Credit Card aligns with your financial goals, you’ll be better prepared to make informed decisions that empower your lifestyle through flexible financing options.